Financial statement

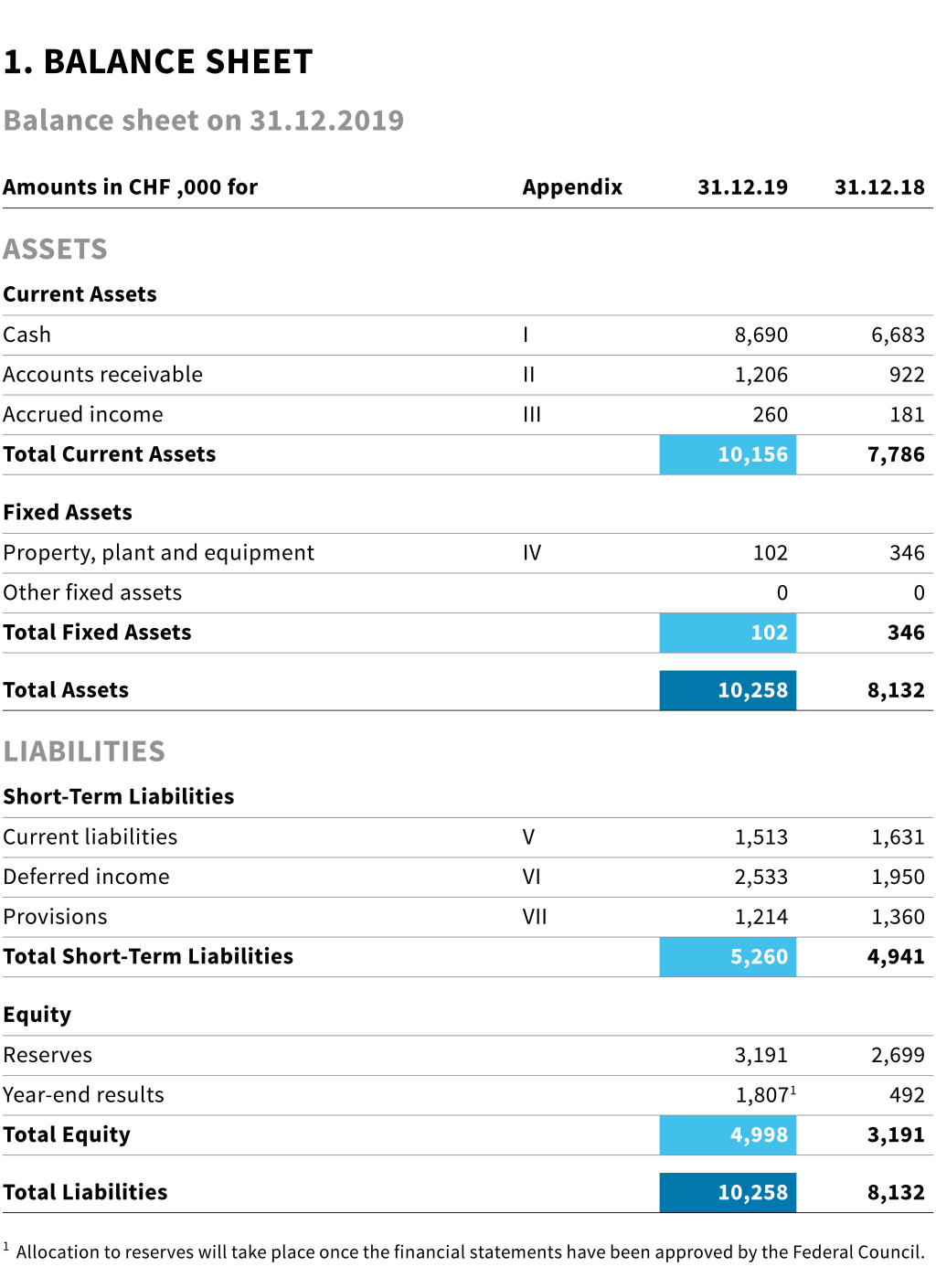

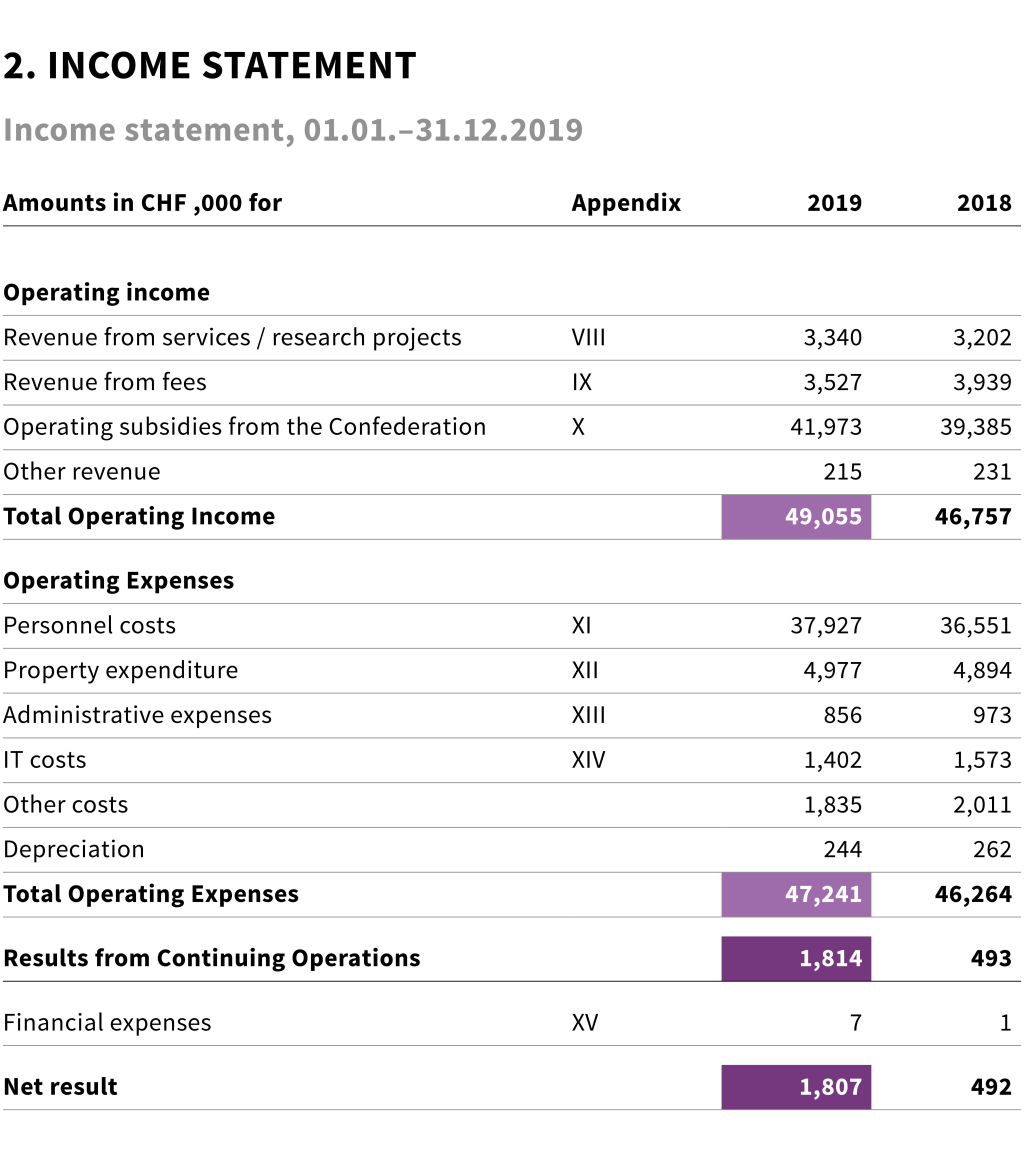

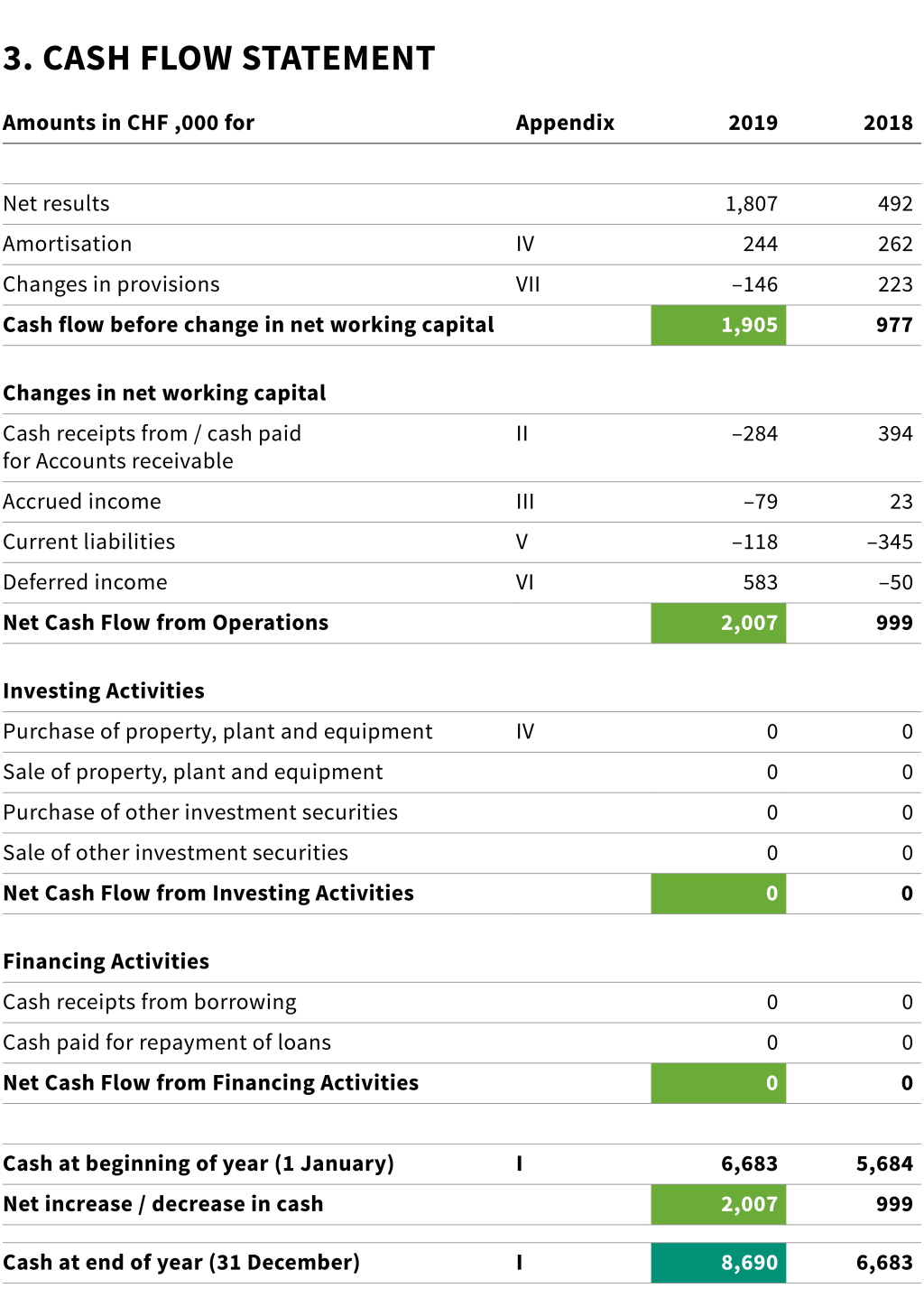

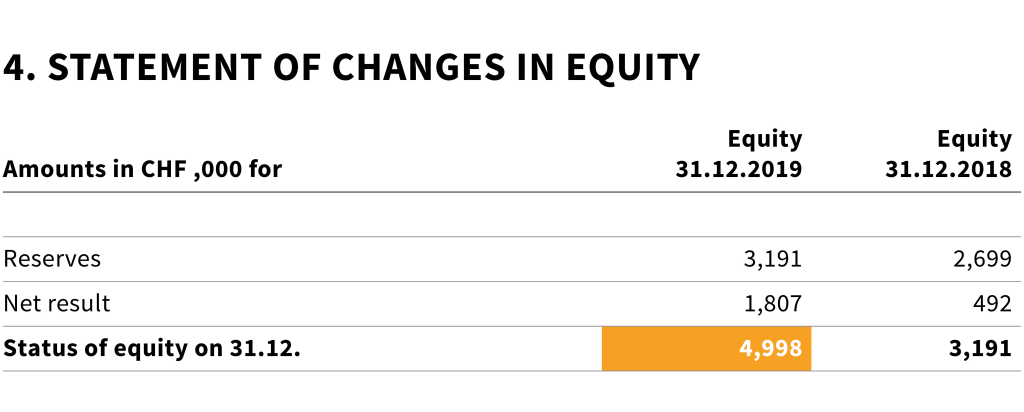

SFIVET's 2019 Financial Statement closed with a budget surplus of CHF 1,807,000 based on an operating income of CHF 49,055,000 and operating expenses of CHF 47,241,000. This compares favourably with the budget surplus of CHF 492,000 achieved in the previous year. This outcome was the result of a combination of greater income and lower budgeted external costs for the digitalisation project, which experienced delays for various reasons. Generally speaking, vocational schools were interested in the digitalisation offer and the Digi-Check was carried out at over one hundred schools. The results of the Digi-Check then gave rise to follow-up offers (i.e. project support and courses). However, due to the complex organisational requirements, the corresponding project support and courses could not be carried out as planned, resulting in delays in the digitalisation project.

According to Article 32 of the Ordinance of 14 September 2005 on the Swiss Federal Institute for Vocational Education and Training (SFIVET Ordinance; SR 412.106.1, status on 20 June 2017), SFIVET may allocate no more than the equivalent of 10% of each year’s budget to reserves. Grants are not included in the calculation.

Reserves are used to offset losses as well as to finance projects and planned capital expenditure. The operating income for 2019 has pushed SFIVET’s reserves above the maximum threshold of 10% of the given annual budget. The amount of CHF 96,000 will be offset against future federal contributions.

5.1 General information

The Swiss Federal Institute for Vocational Education and Training (SFIVET) is a public institution with its own legal personality and registered office in Bern (Art. 2 of SFIVET Ordinance; SR 412.106.1).

According to Article 25 of the SFIVET Ordinance, the Federal Council establishes the SFIVET Board’s strategic objectives. On 9 November 2016, the Federal Council adopted the strategic objectives to be pursued by the SFIVET Board for 2017–2020.

5.2 General information about SFIVET

| Legal form | Public institution with its own legal personality |

| Activities | SFIVET is the Confederation’s competence centre for teaching and research in vocational pedagogy, upper-secondary-level vocational education and training, tertiary-level professional education and the cyclical review and revision of the training content of VET programmes for the whole of Switzerland. SFIVET’s activities include the following:

|

| Locations | Lausanne, Lugano and Zollikofen |

| No. of employees at the end of 2019 | 176 (in FTEs) |

5.3 Generally accepted accounting principles

The present financial statement was prepared in accordance with the accounting principles set forth in the SFIVET Ordinance, namely materiality, clarity, consistency and no-netting. It is also compliant with the accounting standards set forth in the Federal Act of 7 October 2005 on the Federal Financial Budget (Financial Budget Act, FBA; SR 611.0).

Materiality

All information needed for a quick and comprehensive assessment of current assets, finances and earnings should be disclosed.

Clarity

Information must be clear and comprehensible.

Consistency

Bookkeeping and accounting records should remain unchanged over an extended period of time wherever possible.

No-netting

The full amounts of revenue and expenses must be presented separately, without offsetting against each other.

Balancing and valuation

Balancing and valuation principles are determined on the basis of established accounting principles.

Foreign currency

SFIVET’s financial statement for 2019 is presented in Swiss francs (CHF).

Items in foreign currencies are converted to Swiss francs at the closing rate for the transaction in question. Monetary assets and liabilities in foreign currencies are converted to Swiss francs at the closing rate on the balance sheet date and any exchange differences are reported in the income statement.

Revenue entries

Revenue entries use the date when goods are delivered or services rendered.

If the point in time is a determining factor (e.g. date when a decision is reached or an authorisation is given), then the entry will be based either on the date when the service is rendered or the date when the decision is reached.

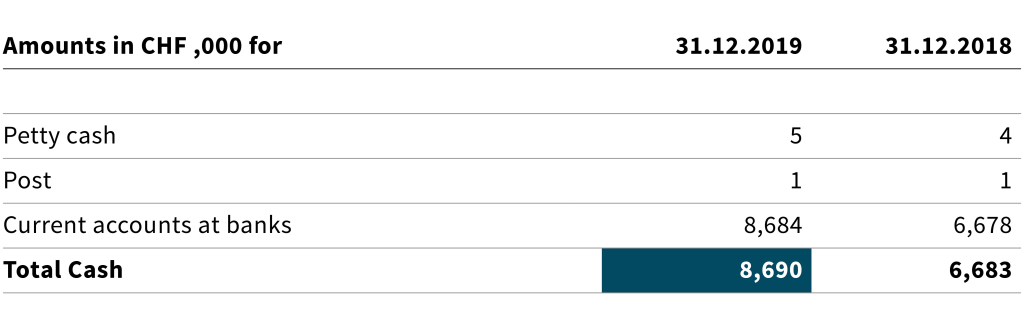

Cash

This includes cash and cash equivalents with a maturity period of 90 days or less (incl. time deposits), which can be readily converted to hard cash at any time. Cash is reported at nominal value.

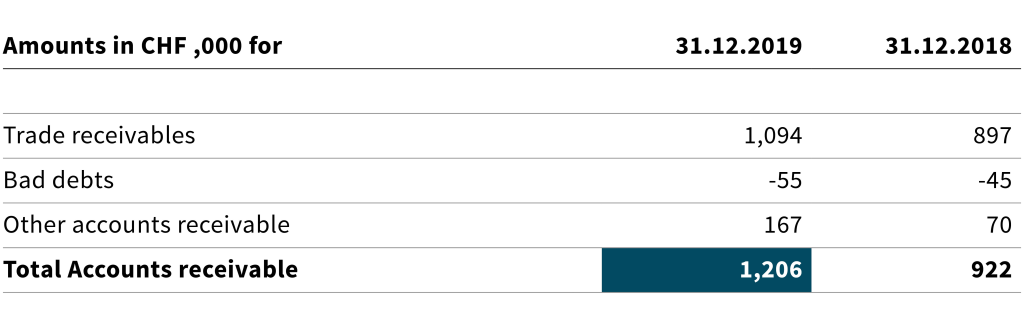

Accounts receivable

The reported amounts correspond to invoiced amounts minus a lump-sum adjustment (for bad debts).

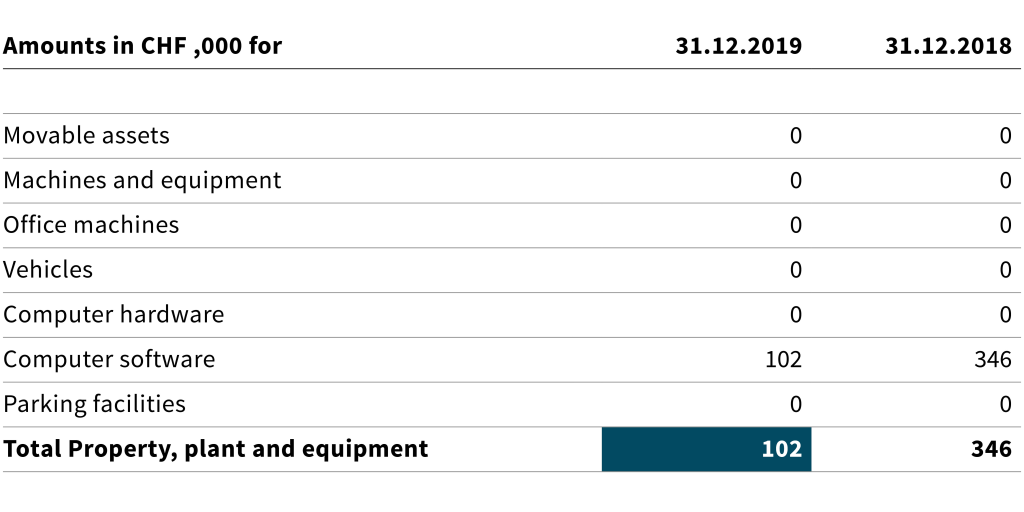

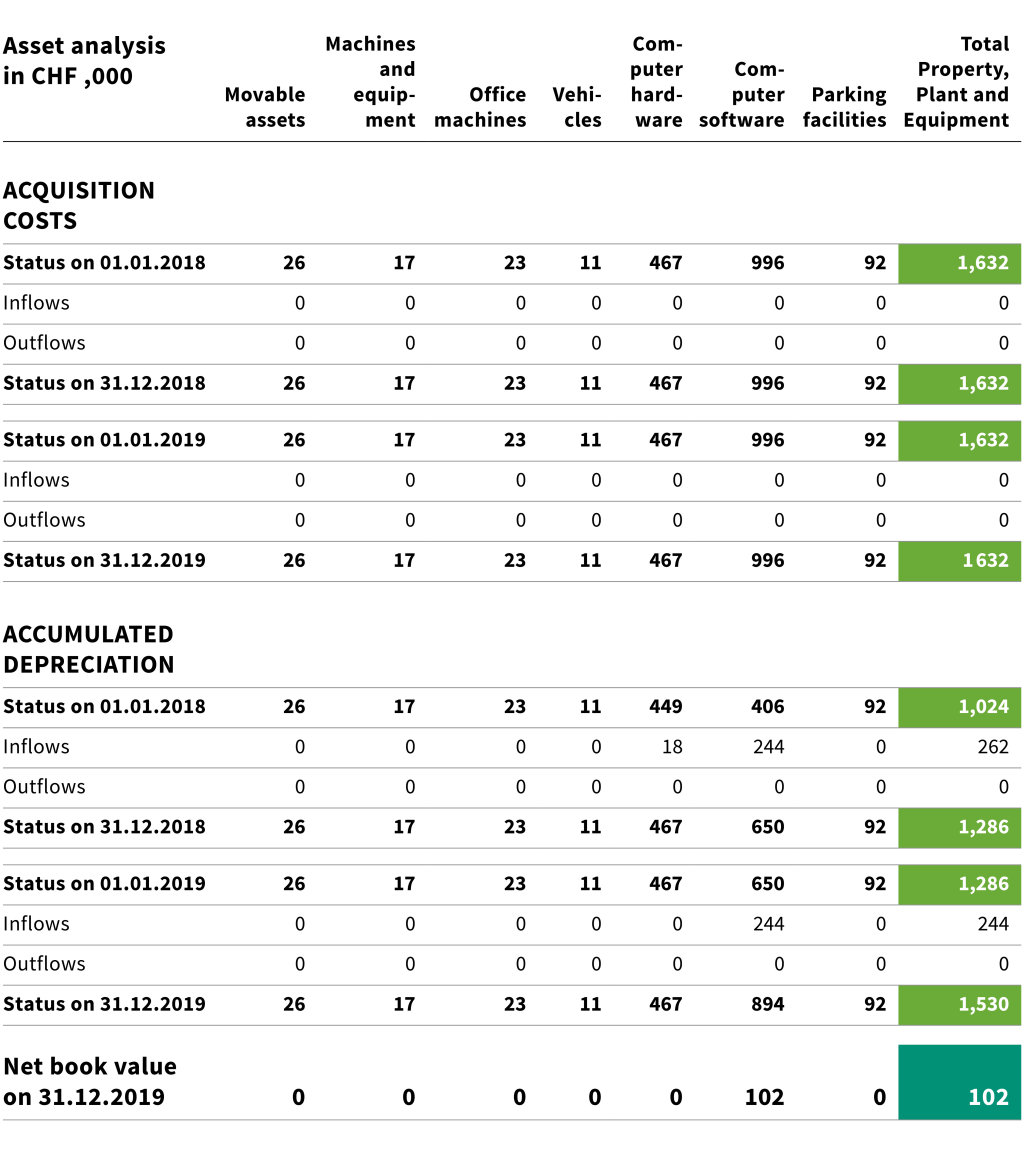

Property, plant and equipment

Property, plant and equipment (PP&E) are valued at the acquisition or production cost and depreciated on the income statement on the basis of the estimated useful life as indicated below:

| Land/buildings | None |

| Movable assets | 5 years |

| Machines and equipment | 5 years |

| Office machines | 5 years |

| Vehicles | 5 years |

| Computer hardware | 3 and 5 years |

| Computer software | 3 years |

The principle of individual valuation applies (Art. 50 para. 3 FBA). According to Art. 56 para. 1 let. b of the Financial Budget Ordinance of 5 April 2006 (FBO; SR 611.01), movable assets must be capitalised when they reach the capitalisation limit of CHF 5,000. Accounting rules do not permit the bundled capitalisation of computer hardware.

Fixed assets are reported as property, plant and equipment if the acquisition value exceeds CHF 5,000. If the acquisition value is lower, then the fixed assets are directly reported as overhead.

Intangible assets

Computer software is listed under fixed assets (PP&E). Other than this, SFIVET has no other intangible assets.

Accounts payable trade

Accounts payable trade are estimated at nominal value.

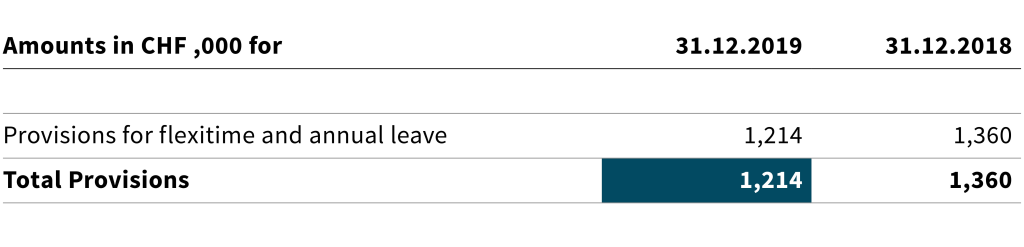

Provisions

Provisions are established when a past event gives rise to a liability that is likely to cause a drain on resources and when the amount of that liability can be reliably determined. If the drain on resources associated with a given liability is deemed unlikely, then this liability is referred to as a contingent liability. Provisions have only been established to cover anticipated costs associated with risk events that have already occurred. No provisions have been established for potential risk events in the future. At the end of the year, provisions are established to cover untaken annual leave, untaken days off, unused flexitime, overtime and other time credits.

Equity

According to Art. 32 of the SFIVET Ordinance (SR 412.106.1), SFIVET may allocate no more than the equivalent of 10% of each year’s budget to reserves.

Reserves are used to offset losses as well as to finance projects and planned capital expenditure.

5.4. Explanations of balance sheet

I Cash

II Accounts receivable

Trade receivables include registration fees and tuition for courses offered by the Basic Training Division as well as fees charged by the Continuing Training Division. It also includes services provided by the Continuing Training Division and the Centre for the Development of Occupations as well as contributions for ongoing projects carried out by the Research & Development Division. The increase of CHF 197,000 is mainly due to the fact that SFIVET billed a larger number of services in December 2019 compared to the same period in the previous year.

Other accounts receivable totalling CHF 167,000 include advances to suppliers, claims for loss of income insurance in the event of illness and the occupational pension fund Publica.

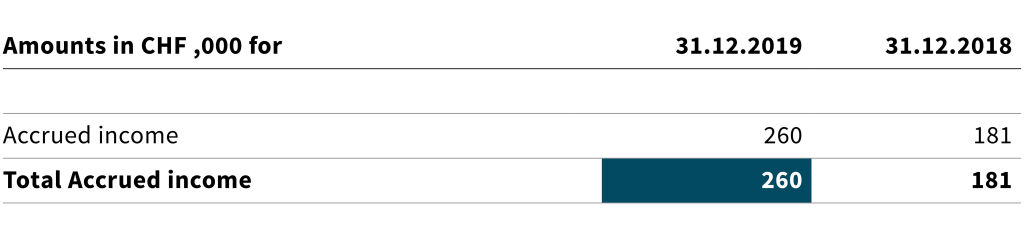

III Accrued income

This entry includes services provided in 2019 that will be billed in 2020.

IV Property, plant and equipment

The purchase of assets worth more than CHF 5,000 is entered here. The purchase of assets worth less than this amount is directly entered as expenditure. The total decrease of CHF 244,000 is exclusively due to depreciation.

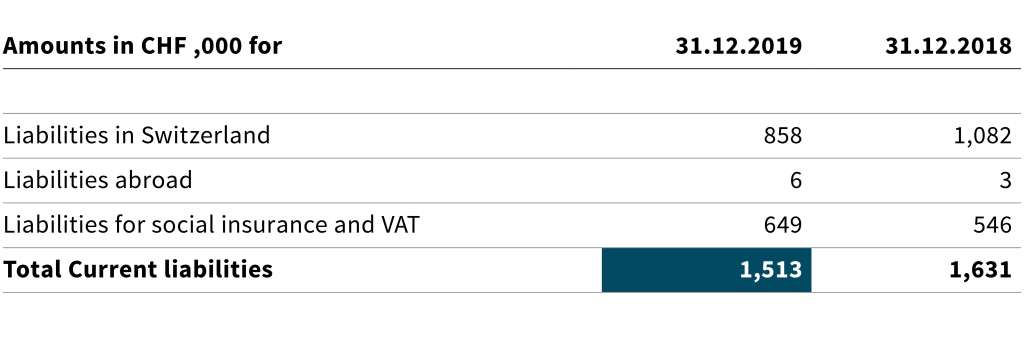

V Current liabilities

Liabilities for social insurance and VAT stand at CHF 649,000. This amount also includes payments to the occupational pension fund totalling CHF 546,000 (2018: CHF 490,000).

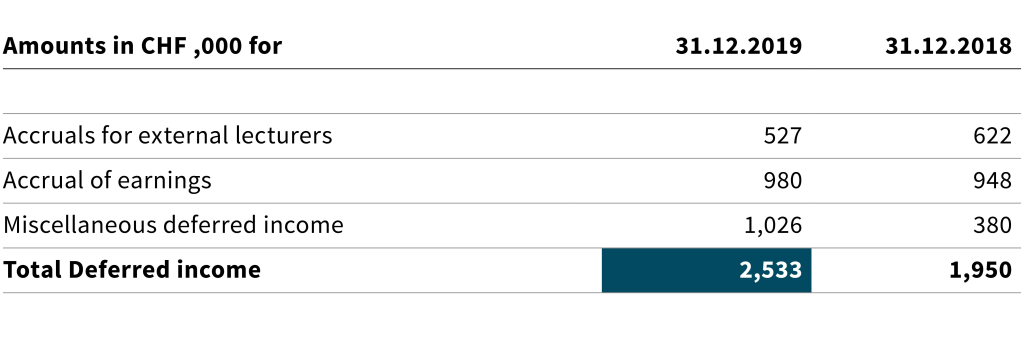

VI Deferred income

The decrease in the item ‘Accruals for external lecturers’ is explained by the fact that some of the services performed were invoiced more quickly in the reporting year. The item ‘Accrual of earnings’ is roughly the same as in the previous year. The increase in the item ‘Miscellaneous accrued expenses and deferred income’ is partly due to supplier invoices relating to the year 2019 that had to be booked to the year 2020 for organisational reasons and to obligations in connection with personnel changes in 2019. On the other hand, this item also includes the accrual of the partial repayment of CHF 384,000 of the federal financial contribution (for the digitalisation action plan). This was because operating income for 2019 pushed SFIVET’s reserves beyond the maximum threshold of 10% of the given annual budget (SFIVET Ordinance; SR 412.106.1).

VII Provisions

At the end of the year, provisions are made for annual leave, rest days, flexitime hours, over time and other time off (e.g. loyalty bonus) that remain unused by the end of the year. Targeted measures were taken in the reporting year, enabling total provisions to be reduced by CHF 146,000.

5.5 Explanations of income statement

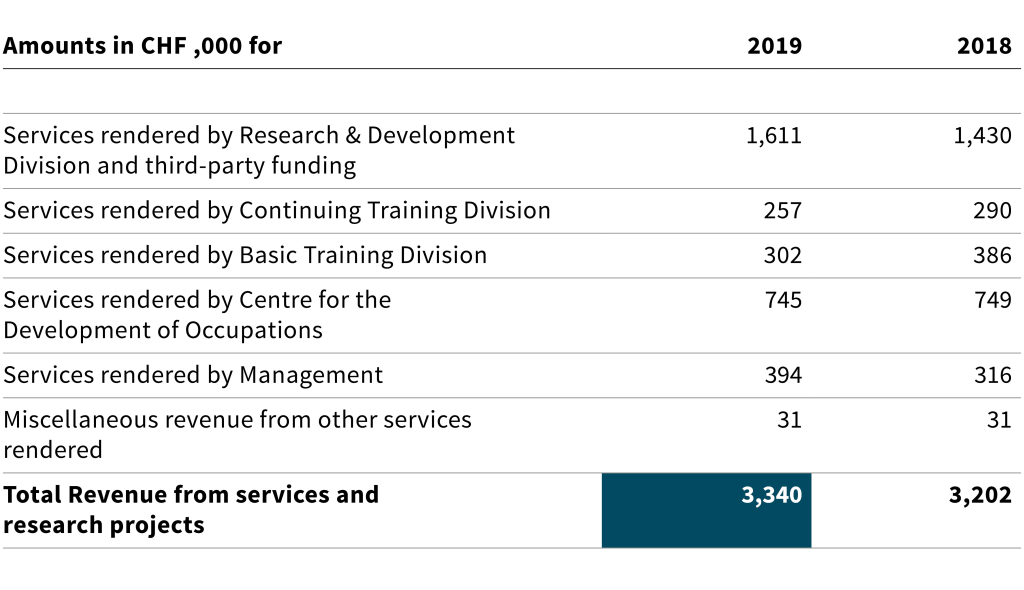

VIII Revenue from services and research projects

Revenue from services and research projects stands at CHF 3,340,000, which constitutes an increase of CHF 138,000 with respect to the previous reporting year. The increase is mainly due to the fact that the Research & Development Division secured more third-party funding and SFIVET management secured additional funding in relation to international projects and training programmes. The lower revenue generated by the Basic Training Division and the Continuing Training Division are due to the fact that fewer lecturing activities could be offered.

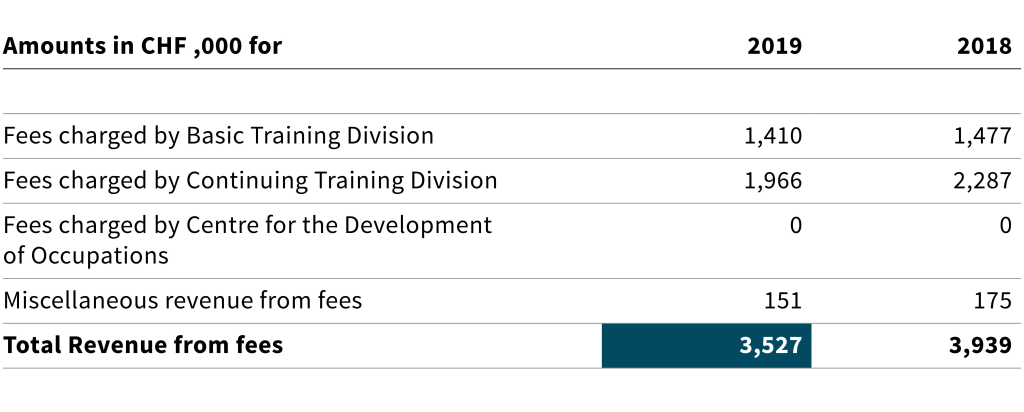

IX Revenue from fees

Income from fees was CHF 412,000 lower than in the previous year. The decrease reported by the Basic Training Division is due in particular to the fact that some of the services provided in 2019 were funded by the trans:formation project (digitalisation).

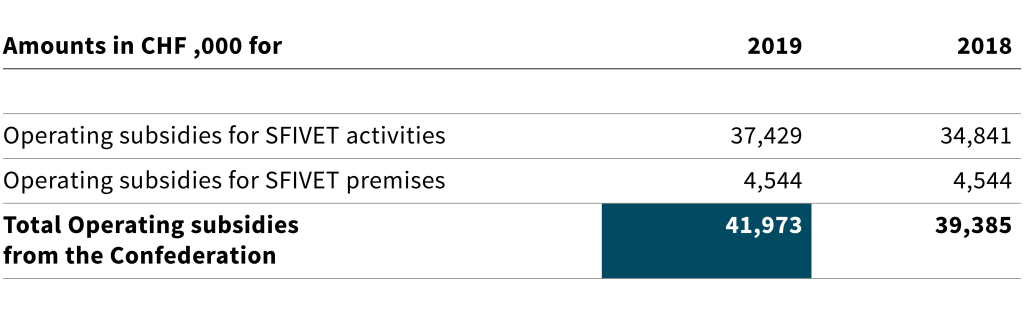

X Operating subsidies from the Confederation

Based on Art. 48 of the Federal Act of 13 December 2002 on Vocational and Professional Education and Training (VPETA, SR 412.10) and on Art. 29 para. 1 let. a of the SFIVET Ordinance of 14 September 2005 (SR 412.106.1), the Confederation provides operating subsidies to help pay for SFIVET activities and leasing costs.

The CHF 2,588 higher operating subsidy resulted from the additionally agreed financial contribution for the digitalisation action plan.

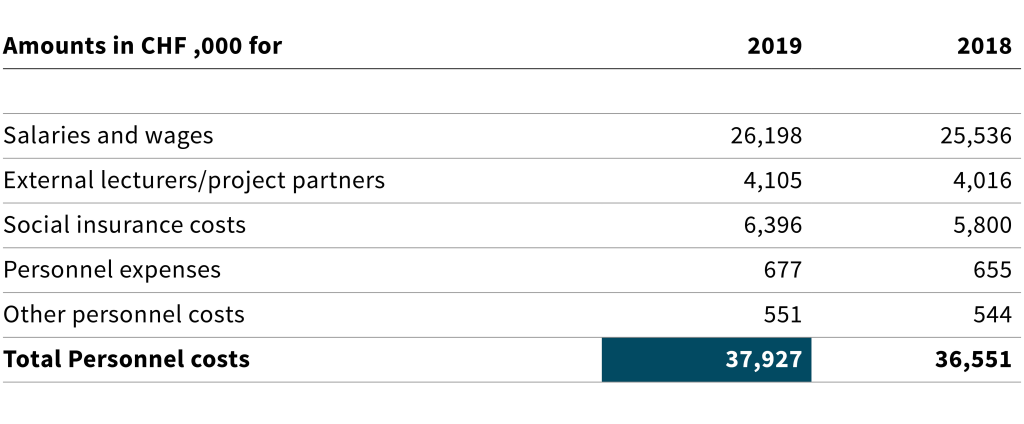

XI Personnel costs

SFIVET increased the number of jobs compared to the previous reporting year by 6 positions, bringing the total up to 175.7 full-time equivalents by year-end. Overall, personnel expenses exceeded the previous year's level by CHF 1,376. The increase in wages is due on the one hand to individual wage increases and inflation and on the other hand to additional costs resulting from the larger number of employees. The higher costs for external lecturers and project partners are attributed to the trans:formation project (digitalisation). The higher social insurance costs are mainly due to the fact that the technical interest rate and the conversion rates for SFIVET's pension fund were reduced as of 1 January 2019. In order to partially offset the consequences of these measures, employee's and employer's pension contributions were increased in 2019.

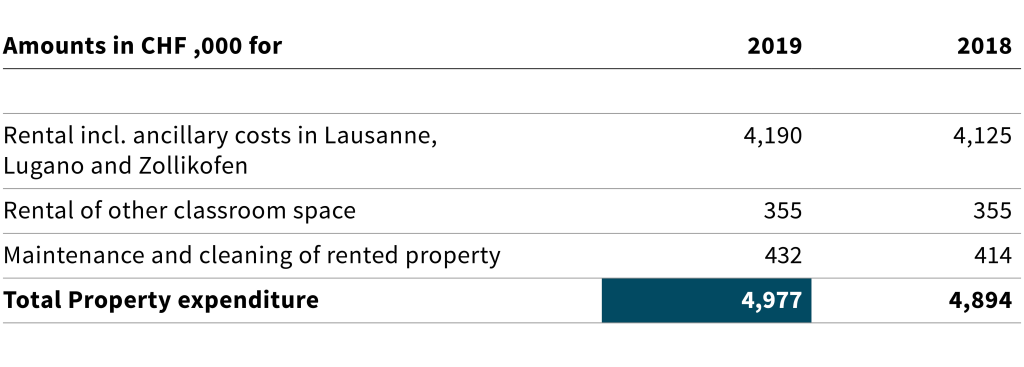

XII Property expenditure

Property expenditure increased by CHF 83,000 compared to the previous reporting year. The increase in leasing costs was the result of additional rental space for the Lugano campus.

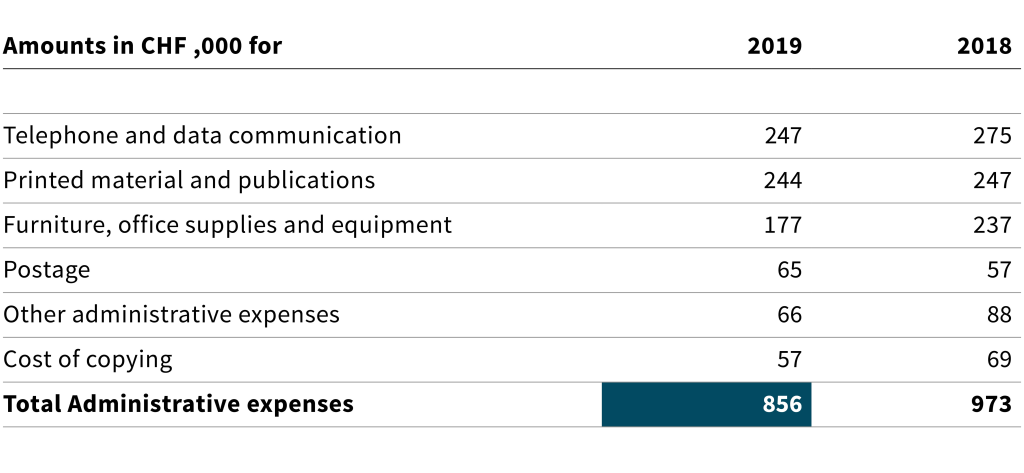

XIII Administrative expenses

Administrative expenses were CHF 117,000 lower than in the previous year. The lower costs for the item ‘Telephone and data communications’ are attributed to the lower cell phone usage costs resulting from signature of new a contract. The item ‘Other administrative expenses’ was also lower due to lower costs for electricity, natural gas and water. The lower costs for the item ‘Furniture, office supplies and equipment’ are due to the fact that the previous reporting year’s costs for modernisation of classrooms were eliminated in the reporting year.

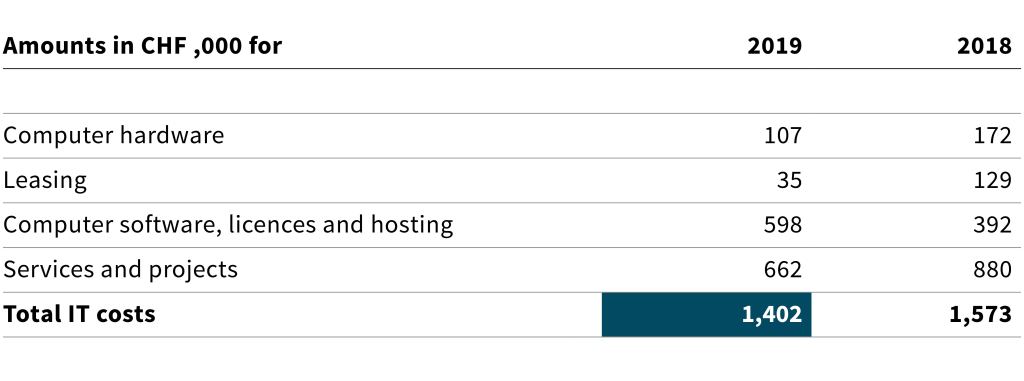

XIV IT costs

IT costs were CHF 171,000 lower than in the previous year. This is due to the fact that there were fewer replacement purchases (hardware) than planned in the reporting year. At the same time, however, extended warranties had to be arranged with suppliers for the hardware infrastructure that was still in use. This, together with extensions of licenses, maintenance contracts and price increases for the Office suite, led to higher costs for computer software, licenses and hosting. Leasing costs, in turn, were lower due to the expiration of leasing contracts (for hardware). The lower costs for the item 'Services and projects' resulted from the fact that fewer orders were placed with third parties.

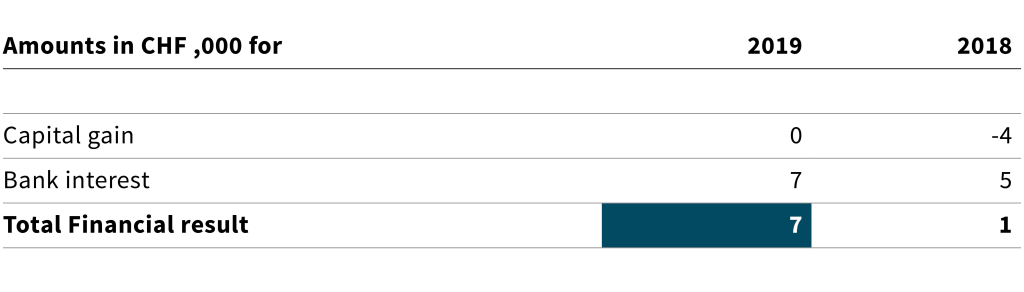

XV Financial result

5.6 General comments

Auditing fees (BDO, Bern) in the reporting year amount to CHF 18,000 (previous year: CHF 20,000).

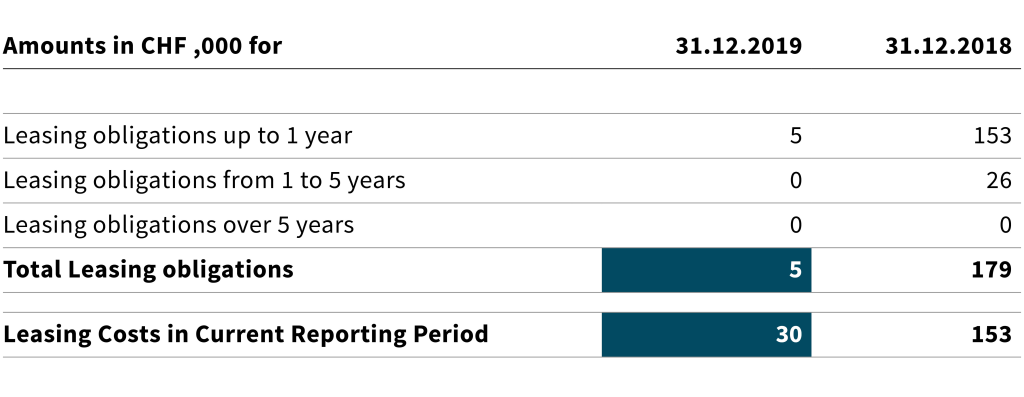

Leasing obligations

Operating leases relate exclusively to IT hardware.

The decrease in leasing costs was due to the termination of certain leasing contracts from the previous reporting year. In addition, no new leasing contracts were signed in the reporting year.

Several liability

SFIVET jointly manages the ‘fordif’ continuing training programme with the University of Geneva, the University of Lausanne and the University of Teacher Education of the Canton of Vaud. Several liability may arise as a result of this partnership.

Events after the balance sheet date

Since the balance sheet date, no events have occurred that would have an impact on the information presented in the financial statement for 2019.

Zollikofen, 17 February 2020

| Angelika Locher SFIVET Board Chairman, ad interim | Gabriel Flück Head of Services |

Carrying out a risk analysis

Each year, the SFIVET Board and the SFIVET Executive Committee carry out a systematic analysis of risks that could potentially skew the information presented in SFIVET’s financial statement. The main risks are assessed in terms of their potential severity and likelihood. These risks are eliminated or reduced whenever possible.