Financial statement

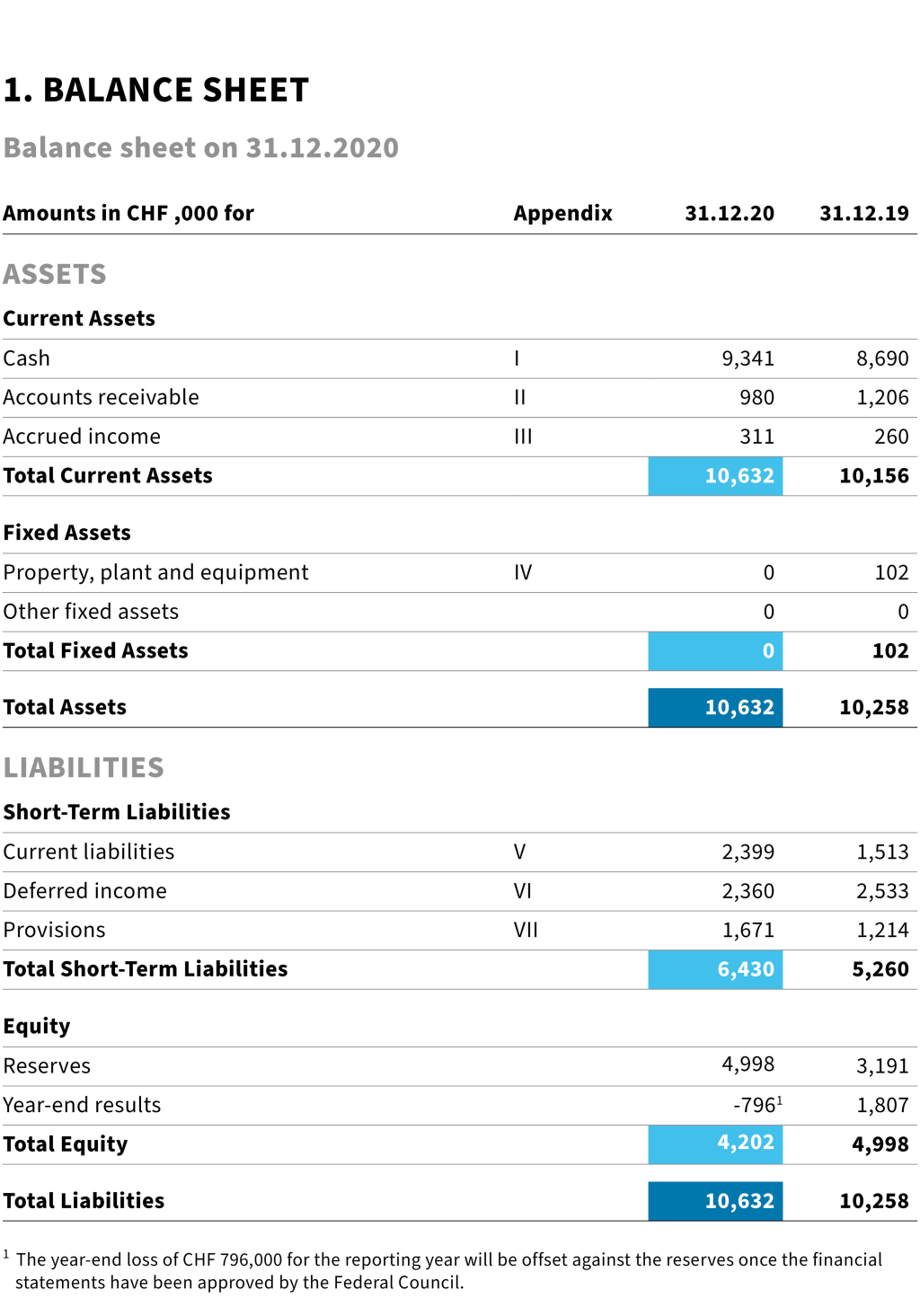

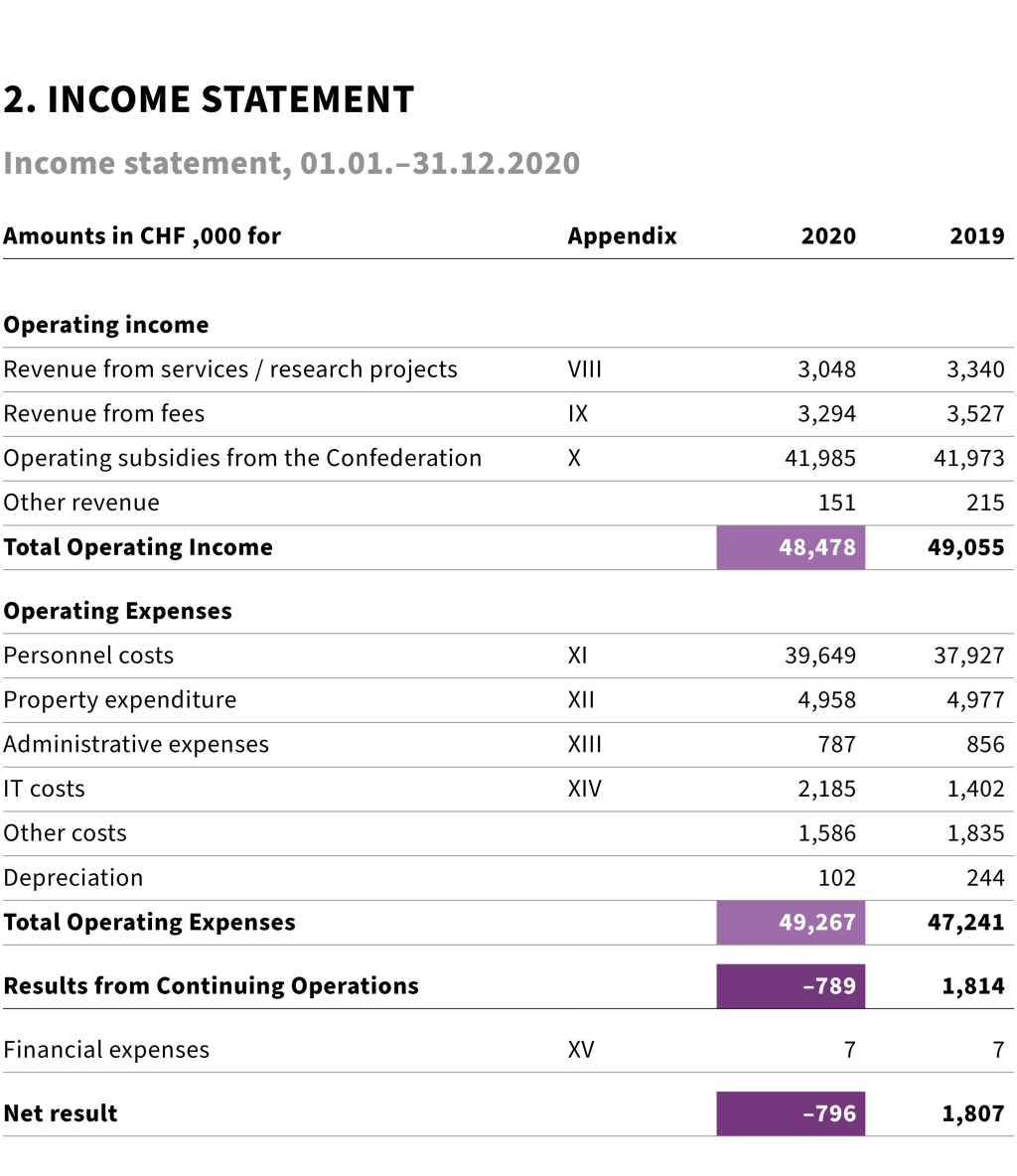

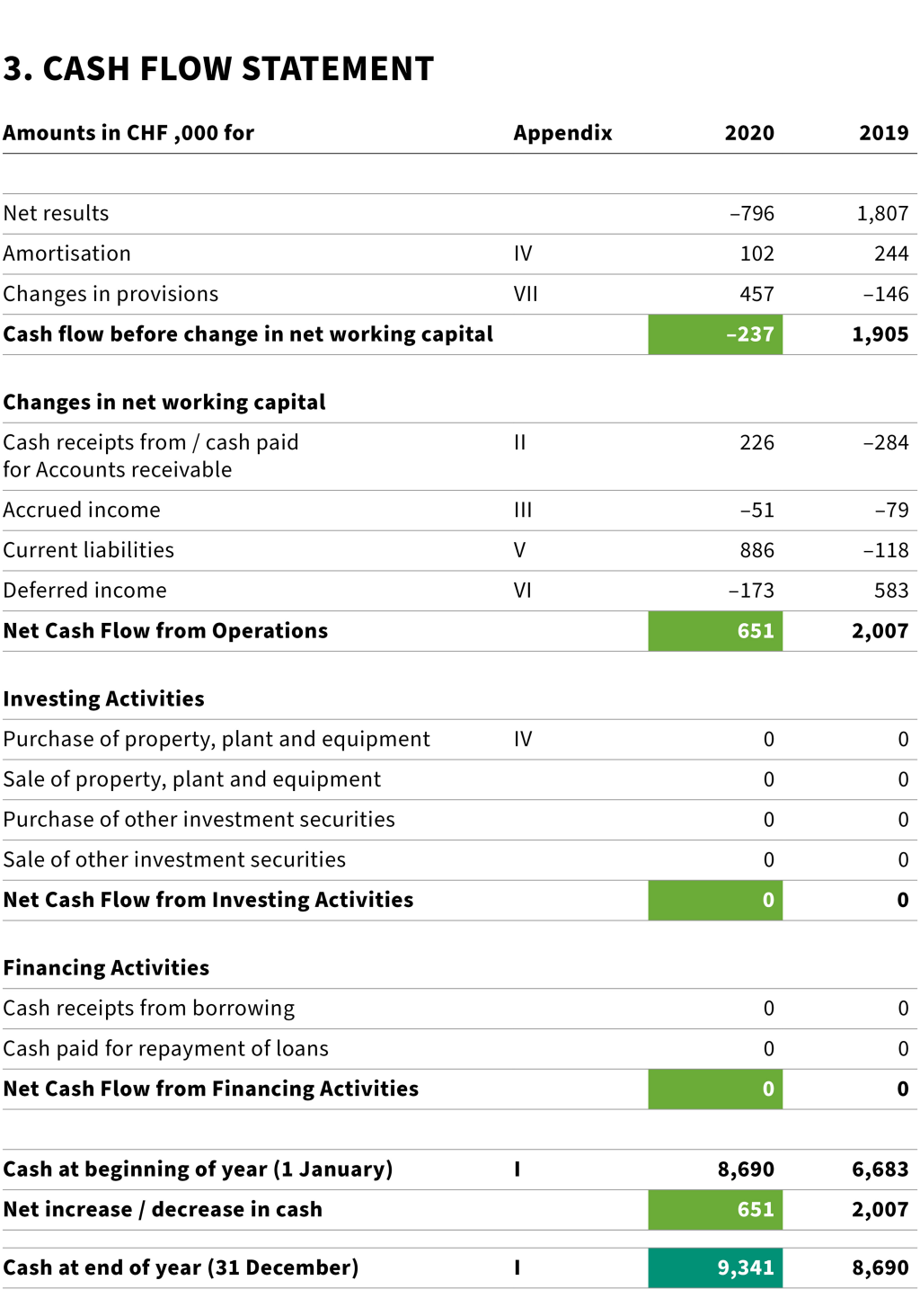

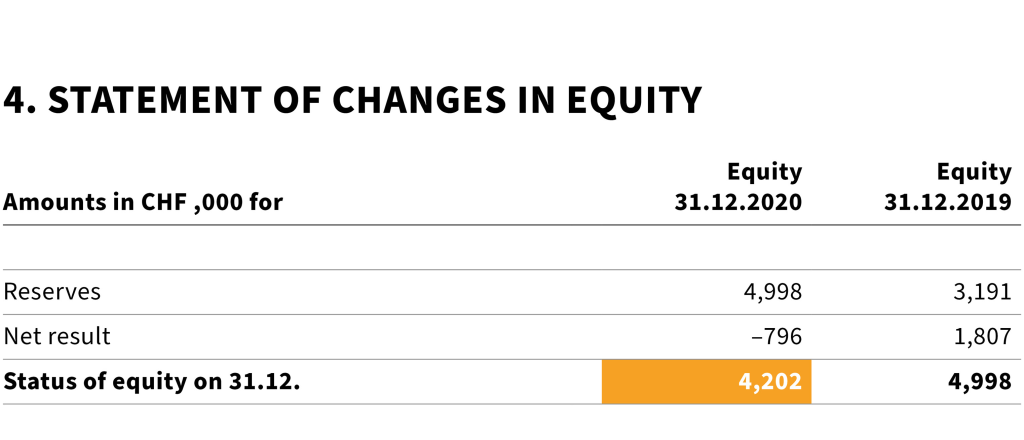

SFIVET's 2020 Financial Statement closed with a budget loss of CHF 796,000 based on an operating income of CHF 48,478,000 and operating expenses of CHF 49,274,000. A budget surplus of CHF 1,807,000 was achieved in the previous reporting year. This outcome was the result of a combination of lower income (Covid-19) and higher costs for personnel and IT. The higher personnel costs can be explained by the larger number of employees (resource-intensive strategic projects) and the need to set aside provisions for vacation and flexitime credits. The increase in IT costs was due in particular to the replacement of laptops.

According to Article 32 of the Ordinance of 14 September 2005 on the Swiss Federal Institute for Vocational Education and Training (SFIVET Ordinance; SR 412.106.1, status on 20 June 2017), SFIVET may allocate no more than the equivalent of 10% of each year’s budget to reserves. Grants are not included in the calculation.

Reserves are used to offset losses as well as to finance projects and planned capital expenditure.

5.1 General information

The Swiss Federal Institute for Vocational Education and Training (SFIVET) is a public institution with its own legal personality and registered office in Berne (Art. 2 of SFIVET Ordinance; SR 412.106.1).

According to Article 25 of the SFIVET Ordinance, the Federal Council establishes the SFIVET Board’s strategic objectives. On 9 November 2016, the Federal Council adopted the strategic objectives to be pursued by the SFIVET Board for 2017-2020.

5.2 General information about SFIVET

| Legal form | Public institution with its own legal personality |

| Activities | SFIVET is the Confederation’s competence centre for teaching and research in vocational pedagogy, upper-secondary-level vocational education and training, tertiary-level professional education and the cyclical review and revision of the training content of VET programmes for the whole of Switzerland. SFIVET’s activities include the following:

|

| Locations | Lausanne, Lugano und Zollikofen |

No. of employees at the end of 2020 | 188 (in FTEs) |

5.3 Generally accepted accounting principles

The present financial statement was prepared in accordance with the accounting principles set forth in the SFIVET Ordinance, namely materiality, clarity, consistency and no-netting. It is also compliant with the accounting standards set forth in the Federal Act of 7 October 2005 on the Federal Financial Budget (Financial Budget Act, FBA; SR 611.0).

Materiality

All information needed for a quick and comprehensive assessment of current assets, finances and earnings should be disclosed.

Clarity

Information must be clear and comprehensible.

Consistency

Bookkeeping and accounting records should remain unchanged over an extended period of time wherever possible.

No-netting

The full amounts of revenue and expenses must be presented separately, without offsetting against each other.

Balancing and valuation

Balancing and valuation principles are determined on the basis of established accounting principles.

Foreign currency

SFIVET’s Financial Statement for 2020 is presented in Swiss francs (CHF).

Items in foreign currencies are converted to Swiss francs at the closing rate for the transaction in question. Monetary assets and liabilities in foreign currencies are converted to Swiss francs at the closing rate on the balance sheet date and any exchange differences are reported in the income statement.

Revenue entries

Revenue entries use the date when goods are delivered or services rendered.

If the point in time is a determining factor (e. g. date when a decision is reached or an authorisation is given), then the entry will be based either on the date when the service is rendered or the date when the decision is reached.

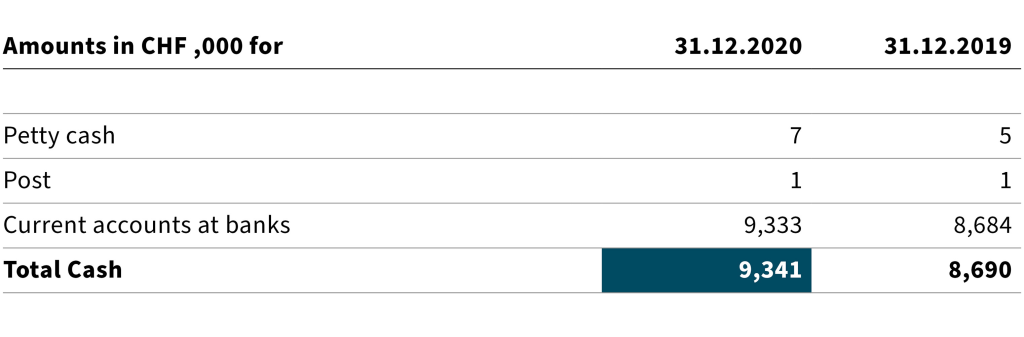

Cash

This includes cash and cash equivalents with a maturity period of 90 days or less (incl. time deposits), which can be readily converted to hard cash at any time. Cash is reported at nominal value.

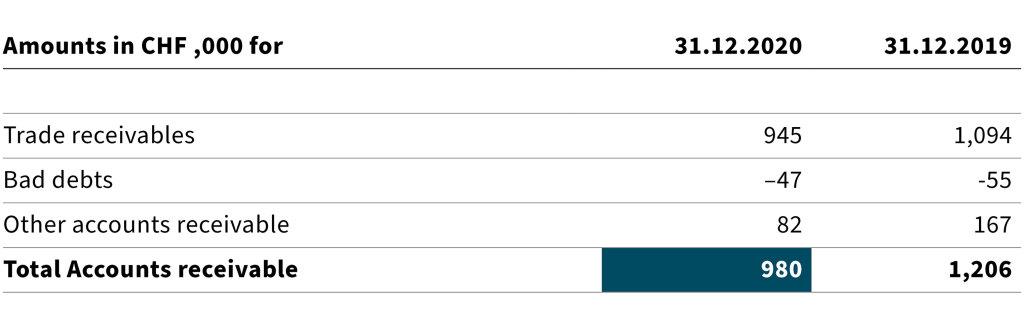

Accounts receivable

The reported amounts correspond to invoiced amounts minus a lump-sum adjustment (for bad debts).

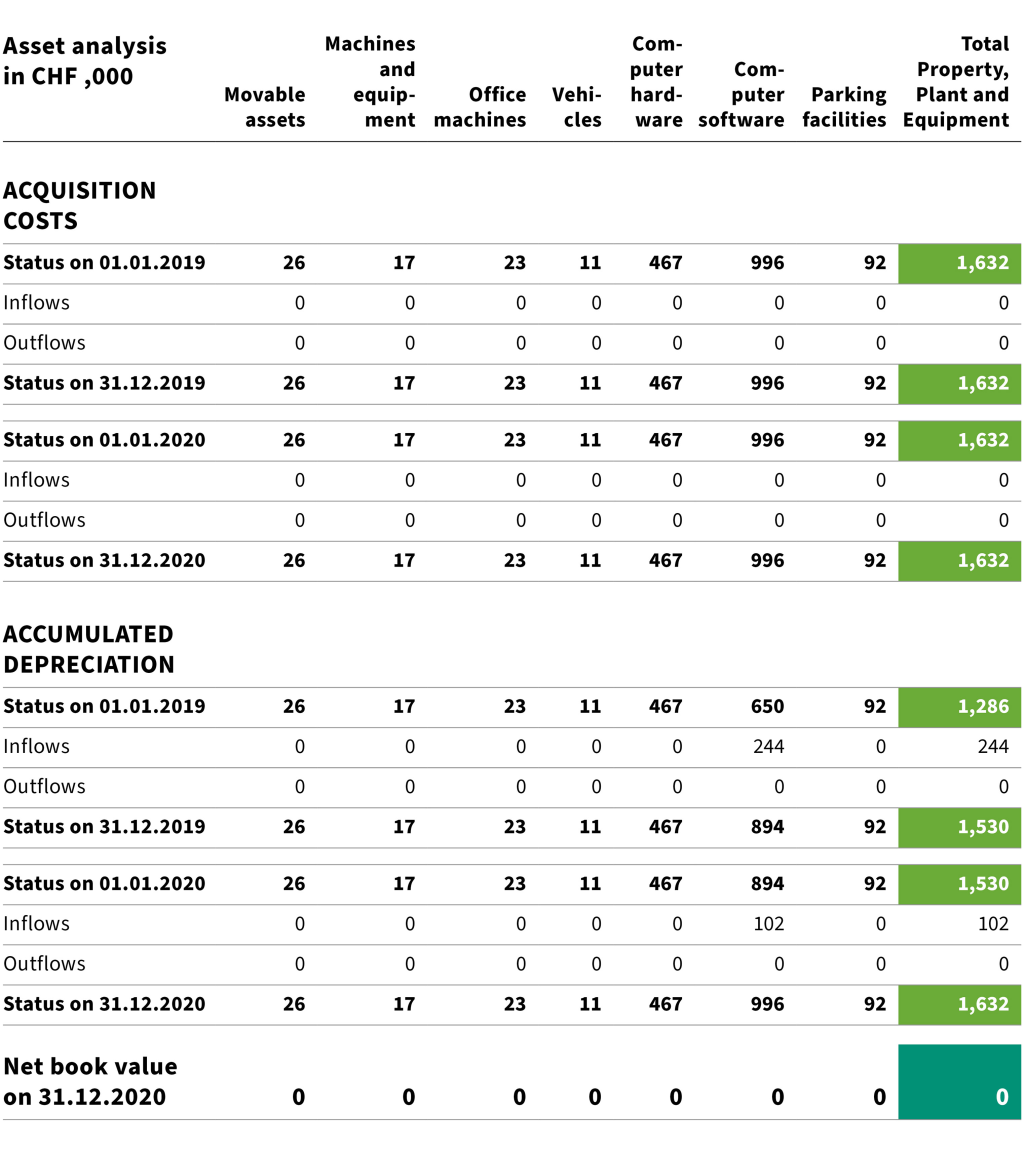

Property, plant and equipment

Property, plant and equipment (PP&E) are valued at the acquisition or production cost and depreciated on the income statement on the basis of the estimated useful life as indicated below

| Land/buildings | None |

| Movable assets | 5 years |

| Machines and equipment | 5 years |

| Office machines | 5 years |

| Vehicles | 5 years |

| Computer hardware | 3 and 5 years |

| Computer software | 3 years |

The principle of individual valuation applies (Art. 50 para. 3 FBA). According to Art. 56 para. 1 let. b of the Financial Budget Ordinance of 5 April 2006 (FBO; SR 611.01), movable assets must be capitalised when they reach the capitalisation limit of CHF 5000. Accounting rules do not permit the bundled capitalisation of computer hardware.

Fixed assets are reported as property, plant and equipment if the acquisition value exceeds CHF 5000. If the acquisition value is lower, then the fixed assets are directly reported as overhead.

Intangible assets

Computer software is listed under fixed assets (PP&E). Other than this, SFIVET has no other intangible assets.

Accounts payable trade

Accounts payable trade are estimated at nominal value.

Provisions

Provisions are established when a past event gives rise to a liability that is likely to cause a drain on resources and when the amount of that liability can be reliably determined. If the drain on resources associated with a given liability is deemed unlikely, then this liability is referred to as a contingent liability.

Provisions have only been established to cover anticipated costs associated with risk events that have already occurred. No provisions have been established for potential risk events in the future.

At the end of the year, provisions are established to cover untaken annual leave, untaken days off, unused flexitime, overtime and other time credits.

Equity

According to Article 32 of the SFIVET Ordinance (SR 412.106.1), SFIVET may allocate no more than the equivalent of 10% of each year’s budget to reserves.

Reserves are used to offset losses as well as to finance projects and planned capital expenditure

5.4 Explanations of balance sheet

I Cash

II Accounts receivable

Trade receivables include registration fees and tuition for courses offered by the Basic Training Division as well as fees charged by the Continuing Training Division. It also includes services provided by the Continuing Training Division and the Centre for the Development of Occupations as well as contributions for ongoing projects carried out by the Research & Development Division. The decrease of CHF 226,000 is mainly due to the fact that SFIVET billed fewer services in December 2020 compared to the same period in the previous year.

Other accounts receivable totalling CHF 82,000 include advances to suppliers, claims for loss of income insurance in the event of illness and the occupational pension fund.

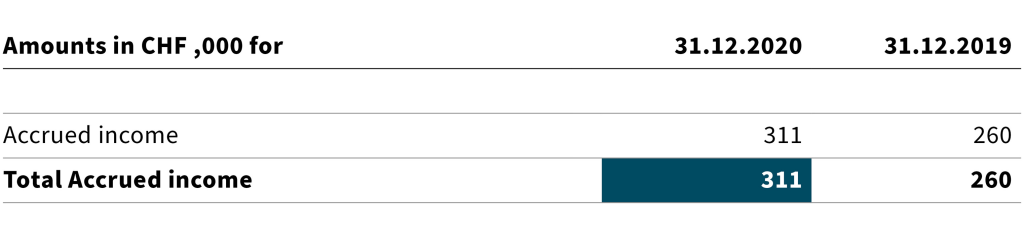

III Accrued income

This entry includes services provided in 2020 that will be billed in 2021.

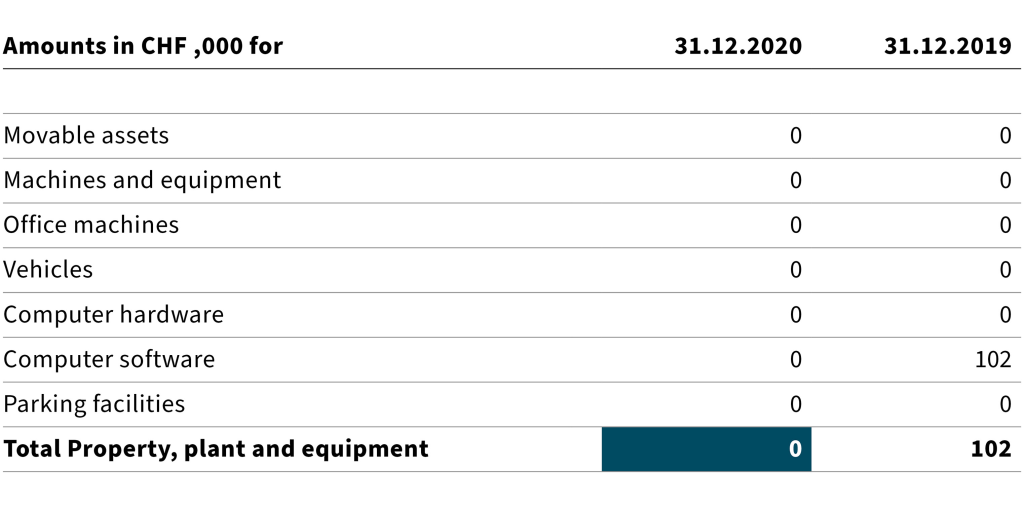

IV Property, plant and equipment

The purchase of assets worth more than CHF 5000 is entered here. The purchase of assets worth less than this amount is directly entered as expenditure.

The total decrease of CHF 102,000 is exclusively due to depreciation.

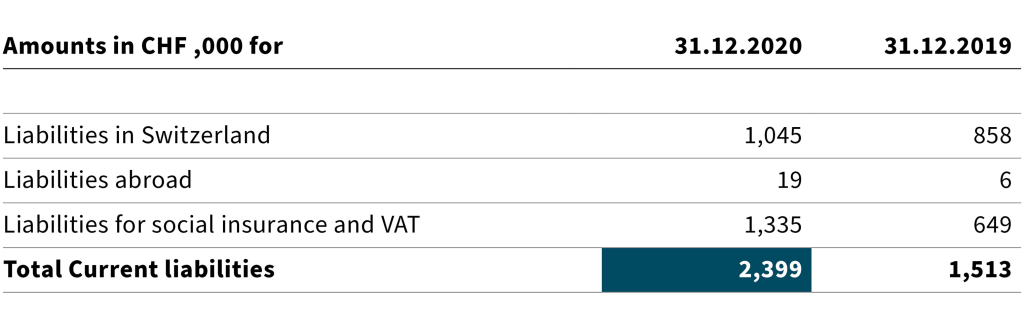

V Current liabilities

Current liabilities for social insurance and VAT stand at CHF 1,335,000. This amount also includes payments to the state pension fund and occupational pension fund totalling CHF 1,232,000 that were paid in January 2021.

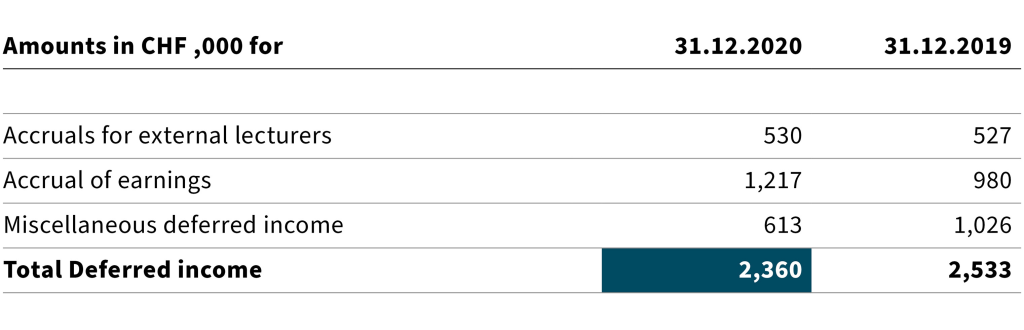

VI Deferred income

The item ‘Accruals for external lecturers’ is roughly the same as the previous year. The increase in the item ‘Accrual of earnings’ can be explained by the fact that more invoices were issued in 2020 for work to be done in the following year than was the case in the previous reporting year. The decrease in the item ‘Miscellaneous accrued expenses and deferred income’ was made possible in part because most of SFIVET’s suppliers managed to submit their invoices for the year 2020 in a timely fashion and because SFIVET had fewer obligations in connection with personnel changes in 2020. On the other hand, this item also includes the accrual of the partial repayment of CHF 333,000 of the federal financial contribution. This was because operating income for 2019 pushed SFIVET’s reserves beyond the maximum threshold of 10% of the given annual budget (SFIVET Ordinance; SR 412.106.1).

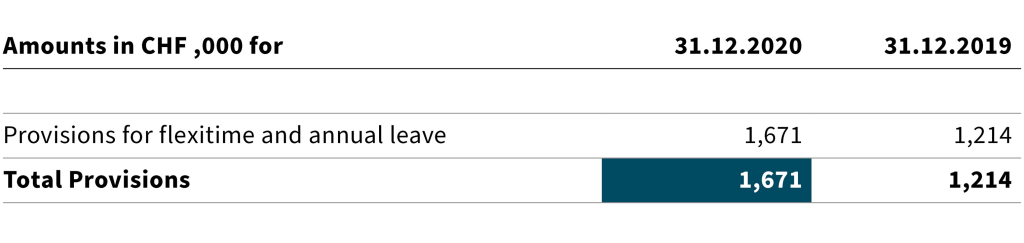

VII Provisions

At the end of the year, provisions are made for annual leave, rest days, flexitime hours, over time and other time off (e.g. loyalty bonus) that remained unused by the end of the year. Targeted measures were taken in the reporting year, enabling total provisions to be increased by CHF 457,000. For one thing, this is related to resource-intensive strategic projects such as Trans:formation (digitalisation), accreditation, SFIVET staff regulations and the new SFIVET Act. In addition, the increase in provisions is attributable to the additional work that had to be done in response to the Covid-19 situation, incl. the switch from face-to-face to digital distance learning.

5.5 Explanations of income statement

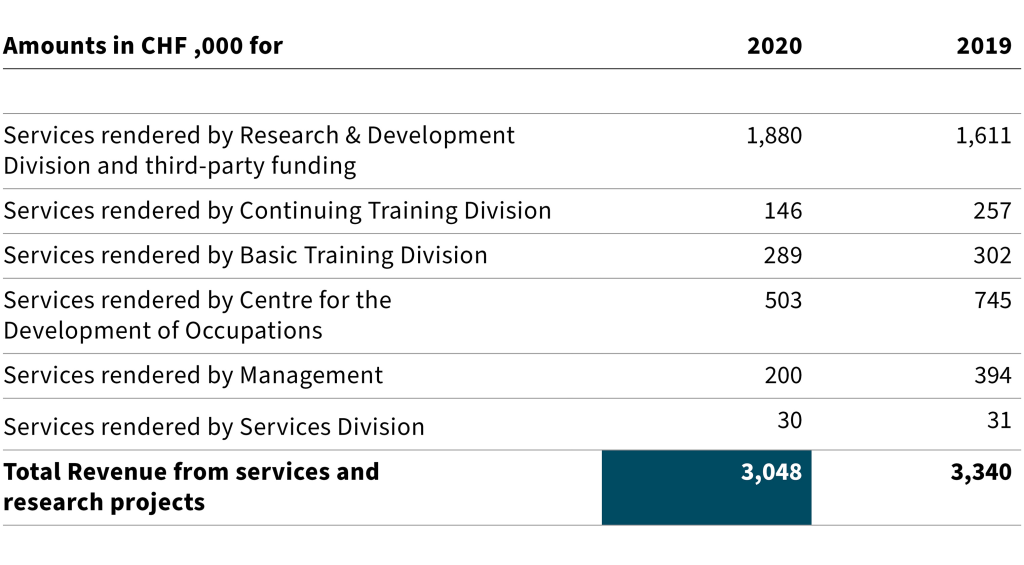

VIII Revenue from services and research projects

Revenue from services and research projects stands at CHF 3,048,000, which constitutes an decrease of CHF 292,000 with respect to the previous reporting year. The decrease is mainly due to the fact that the Research & Development Division secured less third-party funding as a result of the Covid-19 situation. The Basic Training Division, for its part, was able to continue providing its services and courses online. Despite this measure, planned third-party projects had to be postponed until 2021 and 2022. The services rendered by the Centre for the Development of Occupations (CdO) and the Continuing Training Division were also affected because professional organisations and vocational schools changed their priorities in response to the Covid-19 situation. In addition, several international projects pursued by SFIVET management could not be carried out as planned. On the other hand, the Research & Development Division managed to secure greater third-party funding, particularly for SNSF projects.

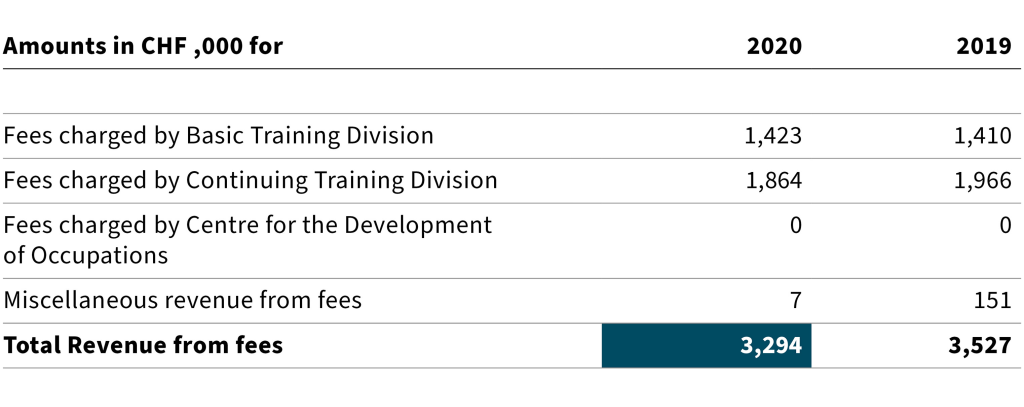

IX Revenue from fees

Revenue from fees was CHF 233,000 lower than in the previous year. The decrease reported by the Continuing Training Division is due in particular to the fact that most of the certification courses could not be held because of government measures taken in response to Covid-19. In addition, SFIVET management had to cancel the planned Swiss VET programmes (reported under the item “Miscellaneous revenue from fees”).

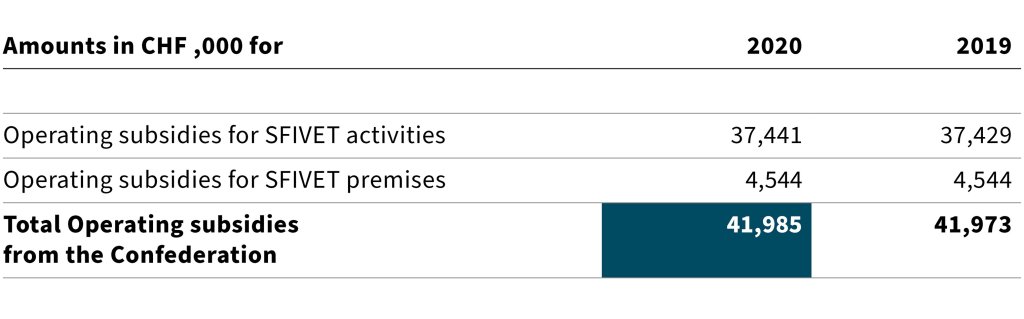

X Operating subsidies from the Confederation

Based on Art. 48 of the Federal Act of 13 December 2002 on Vocational and Professional Education and Training (VPETA, SR 412.10) and on Art. 29 para. 1 let. a of the SFIVET Ordinance of 14 September 2005 (SR 412.106.1), the Confederation provides operating subsidies to help pay for SFIVET activities and leasing costs.

The federal operating subsidy was roughly the same as in the previous year.

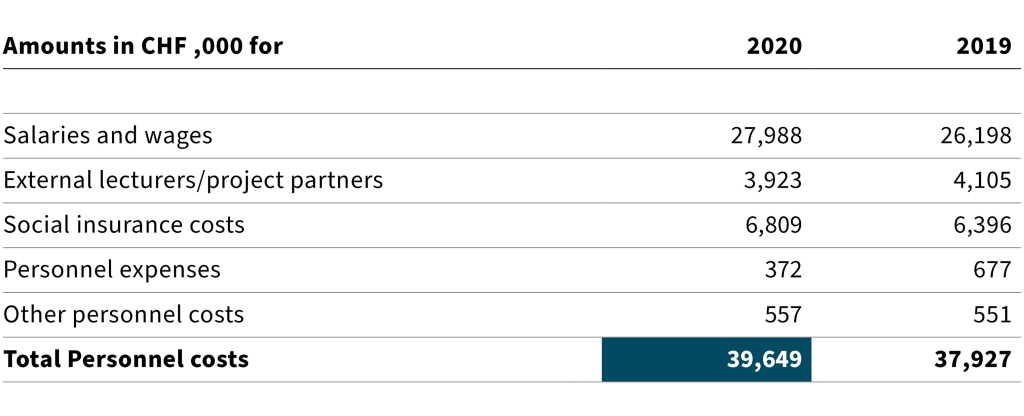

XI Personnel costs

SFIVET increased the number of jobs compared to the previous reporting year by 12 positions, bringing the total up to 188 full-time equivalents by year-end. Overall, personnel expenses exceeded the previous year's level by CHF 1,722. The increase in the "Salaries and wages" item is due to several factors: individual wage increases and inflation; additional costs arising from having hired more employees; and the need to set aside provisions for vacation and flexitime hours. Most of the newly issued employment contracts were fixed-term contracts for resource-intensive strategic projects such as the Trans:formation project (digitalisation) and accreditation. The Covid-19 situation reduced revenue levels, which subsequently led to lower costs for the "External lecturers/project partners" item. The higher social insurance costs mainly came about because there were more employees and this increased overall personnel costs. The decrease reported in the "Personnel expenses" item was due to Covid-19 travel restrictions.

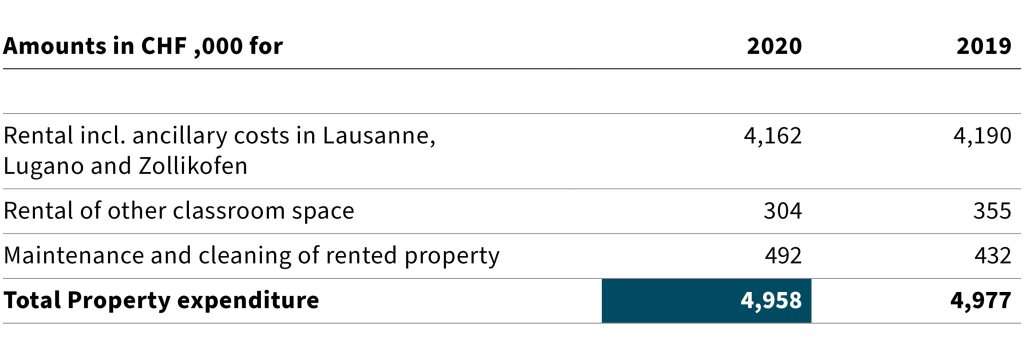

XII Property expenditure

Property expenditure decreased by CHF 19,000 compared to the previous reporting year. The decrease reported for ‘Rental incl. ancillary costs’ was due to refunding of ancillary costs. The decrease in ‘Rental of other classroom space’ came about because of cancellation of planned courses that would otherwise have taken place. In contrast, an increase in costs was reported for the ‘Maintenance and cleaning of rented property’ item.

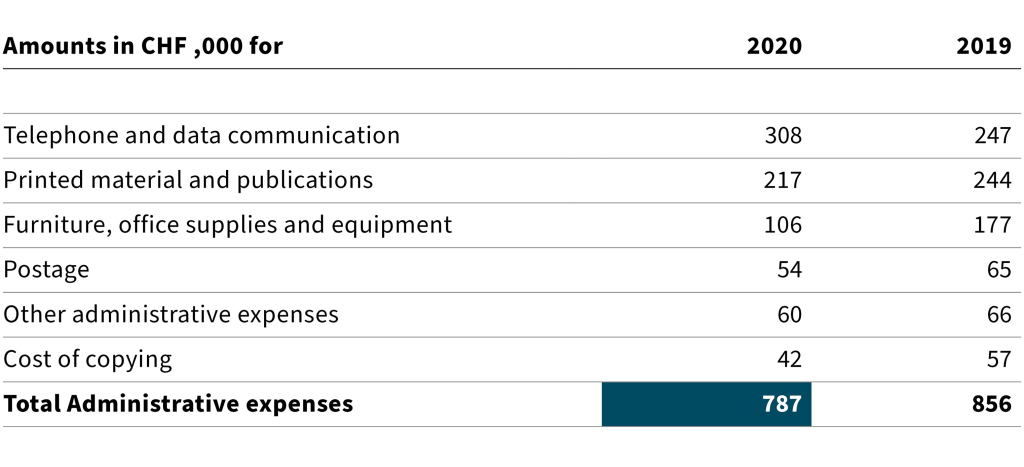

XIII Administrative expenses

Administrative expenses were CHF 69,000 lower than in the previous year. The higher costs for the item ‘Telephone and data communications’ are attributed to the higher usage of the SWITCH module during the Covid-19 period. The costs reported under the item ‘Printed material and publications’ and the item ‘Furniture, office supplies and equipment’ were lower, however.

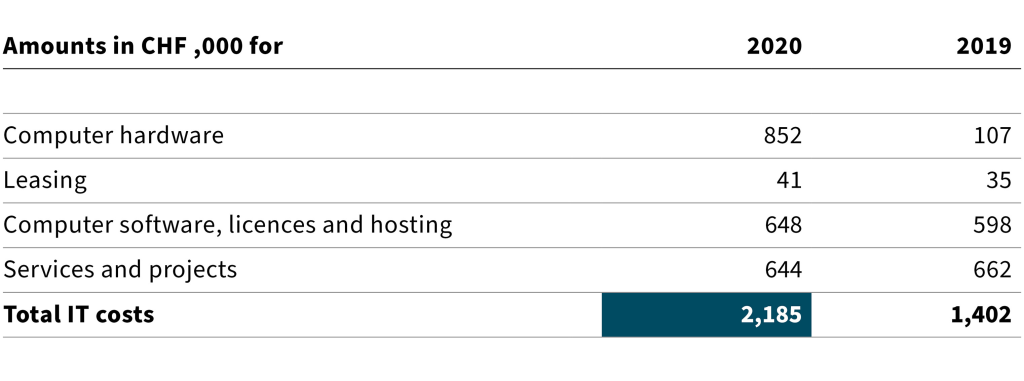

XIV IT costs

IT costs were CHF 783,000 higher than in the previous year. This is due to the fact that replacement laptops had to be purchased (‘Computer hardware’ item) after the end of their five-year cycle. The changeover to home office (Covid-19) required additional hardware purchases (expansion of the network security infrastructure, monitors, keyboards, headphones) as well as additional licences (for SWITCH, Zoom, M365, etc.). These additional costs are reported under the item "Computer software, licences and hosting".

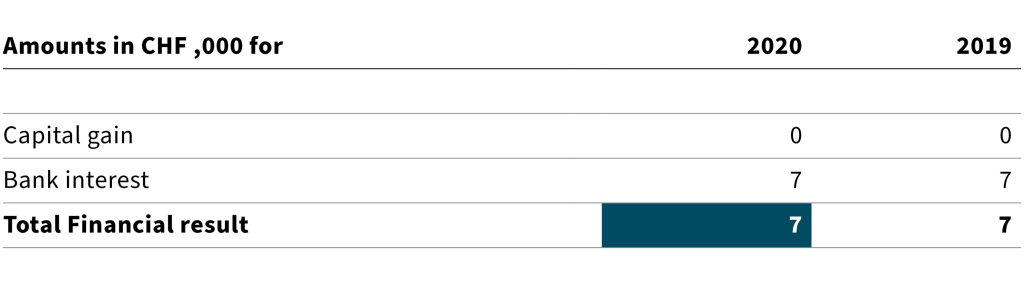

XV Financial result

5.6 General comments

Auditing fees (BDO, Bern) in the reporting year amount to CHF 25,000 (previous year: CHF 18,000)..

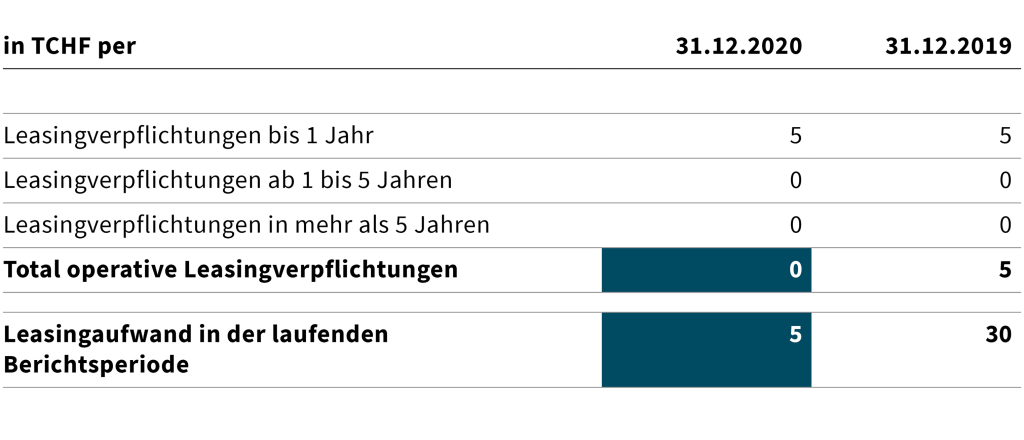

Leasing obligations

There are no more leasing obligations.

Several liability

SFIVET jointly manages the "fordif" continuing training programme with the University of Geneva, the University of Lausanne and the University of Teacher Education of the Canton of Vaud. Several liability may arise as a result of this partnership.

Events after the balance sheet date

Since the balance sheet date, no events have occurred that would have an impact on the information presented in the Financial Statement for 2020.

Zollikofen, 30 March 2021

| Adrian Wüthrich SFIVET Board Chairman | Barbara Fontanellaz Head of Services, ad interim |

Carrying out a risk assessment

The SFIVET Council and the Executive Board have systematically identified the risks that could have an impact on the assessment of SFIVET's financial statements and assessed them on the basis of the extent of damage and probability of occurrence for selected risks. Based on the annually updated risk overview, the most important risks are systematically processed according to their risk potential and eliminated or reduced as far as possible.